This is what happens with two of the stocks in Bursa Malaysia.

Kuala Lumpur Kepong Bhd (KLK) is 46.57% owned by Batu Kawan Berhad Bhd (BKAWAN) (See Appendix (a) for the source of the information). At market price of RM 12.00 per share (at 16th July 2009), the market value of KLK is RM 12.673 Billion , based on 1,064,965,692 shares outstanding (See Appendix (b) for the source of the information).

Since BKAWAN owns 46.57% of KLK, the fractional ownership in KLK is worth RM 5.951 Billion. On top of that, BKAWAN owns RM 386.4 Million of other Tangible Equity, out of which RM 135.4 Million is Net Cash (defined as Total Cash & Cash Equivalent minus Total Debts of the company) (See Appendix (c) for the source of the information).

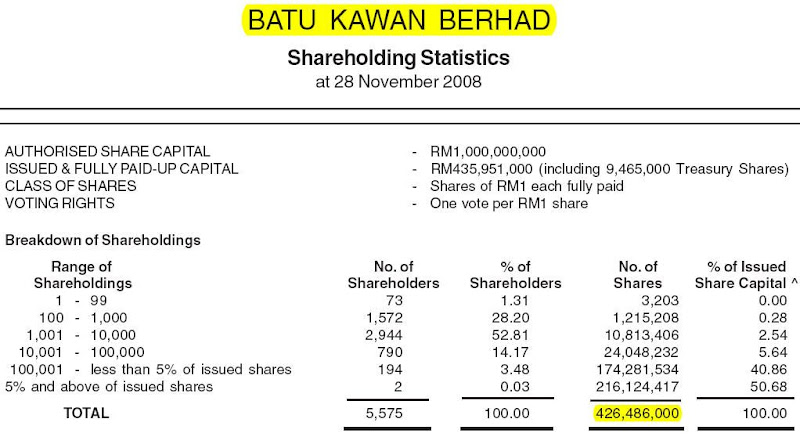

As at 31st March 2009, the number of shares outstanding in BKAWAN (after deducting treasury shares) is 426,487,000 (See Appendix (d) for the source of the information). Given the share price of RM 8.70 on 16th July 2009, the market value of BKAWAN is only RM 3.710 Billion !

Or putting in a table format for BKAWAN, you’ll get (based on 16th July 2009 closing price) (refer to Table 1):

Table 1 : Price vs Value of the entire company of Batu Kawan (BKAWAN)

Stating this, each share of BKAWAN is definitely worth more than KLK share (after all, each BKAWAN shareholders owns 1.1628 shares of KLK + others assets too).

But the market priced KLK share higher than BKAWAN. Infact, BKAWAN is only priced at RM 8.70 while KLK is priced at RM 12.00!.

If you see this as madness, then look at per share basis for BKAWAN (refer to Table 2):

Table 2 : Price vs Value for 1 share of Batu Kawan (BKAWAN)

And if you compare KLK share with BKAWAN share side by side, you’ll get Table 3:

Table 3 : 1 share of KLK vs 1 share of BKAWAN

The more obvious BKAWAN is a better value compared to KLK, the less obvious why “investors” would want to own KLK at higher price and not BKAWAN, which is selling at a lower price than KLK!. If you wonder why people would buy or own shares of KLK at RM 12.00 and not BKAWAN at RM 8.70, I can only share a line from a song by Michael Jackson, “You are not Alone – I am here with you”.

Some “investors” might say KLK have higher volume, which makes it easier for them to trade. On this, it reminds me of a quote by Warren Buffett, “Ease of divorce should not be the reason for marriage”. Infact, he also says, “If you don't feel comfortable owning something for 10 years, then don't own it for 10 minutes.”

Finally, I end with a quote by Warren Buffett on Fortune Magazine (April 3, 1995). He says, “I’d be a bum on the street with a tin cup if the markets were always efficient.” There are mispricing in stocks / securities, if we’re hard working in finding them.

Disclaimer: This article does not constitute a recommendation for buy or sell any stocks or securities. It is purely meant for educational purpose, and the author is not responsible for any loss arising from trade as a result from this article.

b) Shares outstanding for KLK can be found in the 2008’s annual report (http://announcements.bursamalaysia.com/EDMS/subweb.nsf/7f04516f8098680348256c6f0017a6bf/bd4d7b1afc5330534825752f0018ed3f/$FILE/KLK-AnnualReport2008%20(2.8MB).pdf ) page 131 of 141 from the pdf file (or page 129 from the page number in the report).

c) BKAWAN’s tangible assets can be calculated by using the company’s “Equity attributable to equity holders of the company” minus “Goodwill on consolidation” from the 31st March 2009 Consolidated Balance Sheet of BKAWAN’s quarterly report. (http://announcements.bursamalaysia.com/EDMS/AnnWeb.nsf/all/482568AD00295D07482575C3003216F8/$File/BKB%20Q2%202009.pdf ) page 2 of 11 from the pdf file or from the page number in the report.

- “Equity attributable to equity holders of the company” = RM 2,707.3 Million

- “Goodwill on consolidation” = RM 18.4 Million

- “Tangible Equity” = RM 2,707.3 Million - RM 18.4 Million = RM 2,688.9 Million

Since KLK is stated as RM 2,302.5 in the book, the balance (called “Other Tangible Equity”) is RM 386.4 Million.

BKAWAN’s Net Cash can be calculated by using the company’s “Cash and Short Term Investments” minus “Total Debt” from the 31st March 2009 Consolidated Balance Sheet of BKAWAN’s quarterly report. (http://announcements.bursamalaysia.com/EDMS/AnnWeb.nsf/all/482568AD00295D07482575C3003216F8/$File/BKB%20Q2%202009.pdf ) page 2 of 11 from the pdf file or from the page number in the report.

- “Cash and Short Term Investments” = “Short Term Funds” + “Term Deposits” + “Cash and bank balances” = RM 98.4 Million + RM 70.7 Million + RM 1.9 Million = RM 171 Million

- “Total Debt” = “Term Loans” = RM 35.6 Million

- Net Cash = RM 171 Million – RM 35.6 Million = RM 135.4 Million

d) Shares outstanding for BKAWAN can be found in the 2008’s annual report (http://announcements.bursamalaysia.com/EDMS/subweb.nsf/7f04516f8098680348256c6f0017a6bf/d34a06927b8249ef482575280014e45d/$FILE/BKAWAN-AnnualReport2008%20(300KB).pdf ) page 84 of 89 from the pdf file (or page 82 from the page number in the report).