Monday, August 16, 2010

Walter Schloss by Warren Buffett

____________________________________________________________________

Let me end this section by telling you about one of the good guys of Wall Street, my long-time

friend Walter Schloss, who last year turned 90. From 1956 to 2002, Walter managed a remarkably

successful investment partnership, from which he took not a dime unless his investors made money. My admiration for Walter, it should be noted, is not based on hindsight. A full fifty years ago, Walter was my sole recommendation to a St. Louis family who wanted an honest and able investment manager.

Walter did not go to business school, or for that matter, college. His office contained one file

cabinet in 1956; the number mushroomed to four by 2002. Walter worked without a secretary, clerk or bookkeeper, his only associate being his son, Edwin, a graduate of the North Carolina School of the Arts. Walter and Edwin never came within a mile of inside information. Indeed, they used “outside” information only sparingly, generally selecting securities by certain simple statistical methods Walter learned while working for Ben Graham. When Walter and Edwin were asked in 1989 by Outstanding Investors Digest, “How would you summarize your approach?” Edwin replied, “We try to buy stocks cheap.” So much for Modern Portfolio Theory, technical analysis, macroeconomic thoughts and complex algorithms.

Following a strategy that involved no real risk – defined as permanent loss of capital – Walter

produced results over his 47 partnership years that dramatically surpassed those of the S&P 500. It’s particularly noteworthy that he built this record by investing in about 1,000 securities, mostly of a lackluster type. A few big winners did not account for his success. It’s safe to say that had millions of investment managers made trades by a) drawing stock names from a hat; b) purchasing these stocks in comparable amounts when Walter made a purchase; and then c) selling when Walter sold his pick, the luckiest of them would not have come close to equaling his record. There is simply no possibility that what Walter achieved over 47 years was due to chance.

I first publicly discussed Walter’s remarkable record in 1984. At that time “efficient market

theory” (EMT) was the centerpiece of investment instruction at most major business schools. This theory, as then most commonly taught, held that the price of any stock at any moment is not demonstrably mispriced, which means that no investor can be expected to overperform the stock market averages using only publicly-available information (though some will do so by luck). When I talked about Walter 23 years ago, his record forcefully contradicted this dogma.

And what did members of the academic community do when they were exposed to this new and

important evidence? Unfortunately, they reacted in all-too-human fashion: Rather than opening their minds, they closed their eyes. To my knowledge no business school teaching EMT made any attempt to study Walter’s performance and what it meant for the school’s cherished theory.

Instead, the faculties of the schools went merrily on their way presenting EMT as having the

certainty of scripture. Typically, a finance instructor who had the nerve to question EMT had about as much chance of major promotion as Galileo had of being named Pope.

Tens of thousands of students were therefore sent out into life believing that on every day the price

of every stock was “right” (or, more accurately, not demonstrably wrong) and that attempts to evaluate businesses – that is, stocks – were useless. Walter meanwhile went on overperforming, his job made easier by the misguided instructions that had been given to those young minds. After all, if you are in the shipping business, it’s helpful to have all of your potential competitors be taught that the earth is flat.

Maybe it was a good thing for his investors that Walter didn’t go to college.

____________________________________________________________________

His record: http://peterlim80.blogspot.com/2008/10/superinvestors-of-graham-and-doddsville_21.html

A good writeup on Walter J Schloss : http://www.gurufocus.com/news_print.php?id=21786

Monday, July 20, 2009

Obvious Mispricing / Inefficiency of 2 stocks in Bursa Malaysia

This is what happens with two of the stocks in Bursa Malaysia.

Kuala Lumpur Kepong Bhd (KLK) is 46.57% owned by Batu Kawan Berhad Bhd (BKAWAN) (See Appendix (a) for the source of the information). At market price of RM 12.00 per share (at 16th July 2009), the market value of KLK is RM 12.673 Billion , based on 1,064,965,692 shares outstanding (See Appendix (b) for the source of the information).

Since BKAWAN owns 46.57% of KLK, the fractional ownership in KLK is worth RM 5.951 Billion. On top of that, BKAWAN owns RM 386.4 Million of other Tangible Equity, out of which RM 135.4 Million is Net Cash (defined as Total Cash & Cash Equivalent minus Total Debts of the company) (See Appendix (c) for the source of the information).

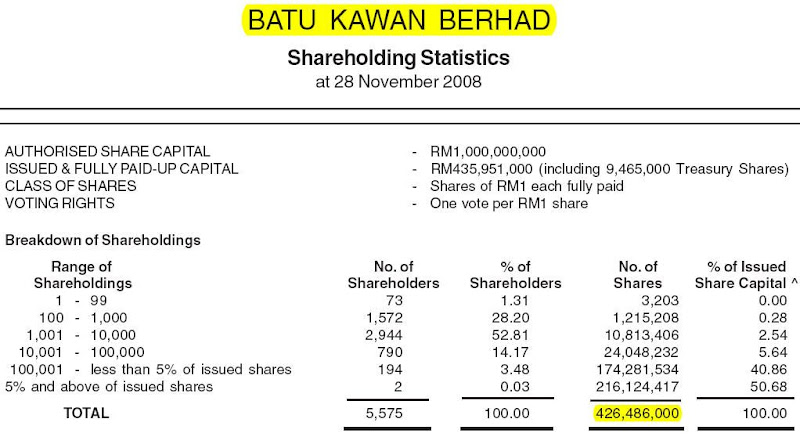

As at 31st March 2009, the number of shares outstanding in BKAWAN (after deducting treasury shares) is 426,487,000 (See Appendix (d) for the source of the information). Given the share price of RM 8.70 on 16th July 2009, the market value of BKAWAN is only RM 3.710 Billion !

Or putting in a table format for BKAWAN, you’ll get (based on 16th July 2009 closing price) (refer to Table 1):

Table 1 : Price vs Value of the entire company of Batu Kawan (BKAWAN)

Stating this, each share of BKAWAN is definitely worth more than KLK share (after all, each BKAWAN shareholders owns 1.1628 shares of KLK + others assets too).

But the market priced KLK share higher than BKAWAN. Infact, BKAWAN is only priced at RM 8.70 while KLK is priced at RM 12.00!.

If you see this as madness, then look at per share basis for BKAWAN (refer to Table 2):

Table 2 : Price vs Value for 1 share of Batu Kawan (BKAWAN)

And if you compare KLK share with BKAWAN share side by side, you’ll get Table 3:

Table 3 : 1 share of KLK vs 1 share of BKAWAN

The more obvious BKAWAN is a better value compared to KLK, the less obvious why “investors” would want to own KLK at higher price and not BKAWAN, which is selling at a lower price than KLK!. If you wonder why people would buy or own shares of KLK at RM 12.00 and not BKAWAN at RM 8.70, I can only share a line from a song by Michael Jackson, “You are not Alone – I am here with you”.

Some “investors” might say KLK have higher volume, which makes it easier for them to trade. On this, it reminds me of a quote by Warren Buffett, “Ease of divorce should not be the reason for marriage”. Infact, he also says, “If you don't feel comfortable owning something for 10 years, then don't own it for 10 minutes.”

Finally, I end with a quote by Warren Buffett on Fortune Magazine (April 3, 1995). He says, “I’d be a bum on the street with a tin cup if the markets were always efficient.” There are mispricing in stocks / securities, if we’re hard working in finding them.

Disclaimer: This article does not constitute a recommendation for buy or sell any stocks or securities. It is purely meant for educational purpose, and the author is not responsible for any loss arising from trade as a result from this article.

b) Shares outstanding for KLK can be found in the 2008’s annual report (http://announcements.bursamalaysia.com/EDMS/subweb.nsf/7f04516f8098680348256c6f0017a6bf/bd4d7b1afc5330534825752f0018ed3f/$FILE/KLK-AnnualReport2008%20(2.8MB).pdf ) page 131 of 141 from the pdf file (or page 129 from the page number in the report).

c) BKAWAN’s tangible assets can be calculated by using the company’s “Equity attributable to equity holders of the company” minus “Goodwill on consolidation” from the 31st March 2009 Consolidated Balance Sheet of BKAWAN’s quarterly report. (http://announcements.bursamalaysia.com/EDMS/AnnWeb.nsf/all/482568AD00295D07482575C3003216F8/$File/BKB%20Q2%202009.pdf ) page 2 of 11 from the pdf file or from the page number in the report.

- “Equity attributable to equity holders of the company” = RM 2,707.3 Million

- “Goodwill on consolidation” = RM 18.4 Million

- “Tangible Equity” = RM 2,707.3 Million - RM 18.4 Million = RM 2,688.9 Million

Since KLK is stated as RM 2,302.5 in the book, the balance (called “Other Tangible Equity”) is RM 386.4 Million.

BKAWAN’s Net Cash can be calculated by using the company’s “Cash and Short Term Investments” minus “Total Debt” from the 31st March 2009 Consolidated Balance Sheet of BKAWAN’s quarterly report. (http://announcements.bursamalaysia.com/EDMS/AnnWeb.nsf/all/482568AD00295D07482575C3003216F8/$File/BKB%20Q2%202009.pdf ) page 2 of 11 from the pdf file or from the page number in the report.

- “Cash and Short Term Investments” = “Short Term Funds” + “Term Deposits” + “Cash and bank balances” = RM 98.4 Million + RM 70.7 Million + RM 1.9 Million = RM 171 Million

- “Total Debt” = “Term Loans” = RM 35.6 Million

- Net Cash = RM 171 Million – RM 35.6 Million = RM 135.4 Million

d) Shares outstanding for BKAWAN can be found in the 2008’s annual report (http://announcements.bursamalaysia.com/EDMS/subweb.nsf/7f04516f8098680348256c6f0017a6bf/d34a06927b8249ef482575280014e45d/$FILE/BKAWAN-AnnualReport2008%20(300KB).pdf ) page 84 of 89 from the pdf file (or page 82 from the page number in the report).

Friday, December 19, 2008

What Warren Buffett says about Diversification

Says Buffett, "If you are not a professional investor, if your goal is not to manage money in such a way that you get a significantly better return than world, then I believe in extreme diversification. I believe that 98 or 99 percent — maybe more than 99 percent — of people who invest should extensively diversify and not trade. That leads them to an index fund with very low costs. All they’re going to do is own a part of America. They’ve made a decision that owning a part of America is worthwhile. I don’t quarrel with that at all — that is the way they should approach it."

Wednesday, November 26, 2008

Video conference with Walter J Schloss on 12 Feb 2008

Walter Schloss is one of the Superinvestors of Graham-and-Doddsville (Read more about his track record here: http://peterlim80.blogspot.com/2008/10/superinvestors-of-graham-and-doddsville_21.html ).

If there is one statement which is repeated a number of times by him, it is, “I don’t like to lose money.” I think that was the most used statement by him in the recording.

He seems to have very simple rules for investing:

1. Low Debt

2. Good History

3. Price

4. Management

5. Investor Characteristics

If you like this video, you can download it at : http://www.bengrahaminvesting.ca/Resources/Video_Presentations/Walter_J_Schloss.wmv

A good writeup about Walter J Schloss : http://www.gurufocus.com/news_print.php?id=21786

Monday, November 3, 2008

What Warren Buffett writes about marketable securities (or stocks)

Download the article in here: http://www.scribd.com/doc/7855212/Marketable-Securities

____________________________________________________________________

Marketable Securities - Permanent Holdings

Whenever Charlie and I buy common stocks for Berkshire's insurance companies (leaving aside arbitrage purchases, discussed later) we approach the transaction as if we were buying into a private business. We look at the economic prospects of the business, the people in charge of running it, and the price we must pay. We do not have in mind any time or price for sale. Indeed, we are willing to hold a stock indefinitely so long as we expect the business to increase in intrinsic value at a satisfactory rate. When investing, we view ourselves as business analysts - not as market analysts, not as macroeconomic analysts, and not even as security analysts.

Our approach makes an active trading market useful, since it periodically presents us with mouth-watering opportunities. But by no means is it essential: a prolonged suspension of trading in the securities we hold would not bother us any more than does the lack of daily quotations on World Book or Fechheimer. Eventually, our economic fate will be determined by the economic fate of the business we own, whether our ownership is partial or total.

Ben Graham, my friend and teacher, long ago described the mental attitude toward market fluctuations that I believe to be most conducive to investment success. He said that you should imagine market quotations as coming from a remarkably accommodating fellow named Mr. Market who is your partner in a private business. Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his.

Even though the business that the two of you own may have economic characteristics that are stable, Mr. Market's quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems. At times he feels euphoric and can see only the favourable factors affecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains. At other times he is depressed and can see nothing but trouble ahead for both the business and the world. On these occasions he will name a very low price, since he is terrified that you will unload your interest on him.

Mr. Market has another endearing characteristic: He doesn't mind being ignored. If his quotation is uninteresting to you today, he will be back with a new one tomorrow. Transactions are strictly at your option. Under these conditions, the more manic-depressive his behaviour, the better for you.

But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence. Indeed, if you aren't certain that you understand and can value your business far better than Mr. Market, you don't belong in the game. As they say in poker, "If you've been in the game 30 minutes and you don't know who the patsy is, you're the patsy."

Ben's Mr. Market allegory may seem out-of-date in today's investment world, in which most professionals and academicians talk of efficient markets, dynamic hedging and betas. Their interest in such matters is understandable, since techniques shrouded in mystery clearly have value to the purveyor of investment advice. After all, what witch doctor has ever achieved fame and fortune by simply advising "Take two aspirins"?

The value of market esoterica to the consumer of investment advice is a different story. In my opinion, investment success will not be produced by arcane formulae, computer programs or signals flashed by the price behaviour of stocks and markets. Rather an investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behaviour from the super-contagious emotions that swirl about the marketplace. In my own efforts to stay insulated, I have found it highly useful to keep Ben's Mr. Market concept firmly in mind.

Following Ben's teachings, Charlie and I let our marketable equities tell us by their operating results - not by their daily, or even yearly, price quotations - whether our investments are successful. The market may ignore business success for a while, but eventually will confirm it. As Ben said: "In the short run, the market is a voting machine but in the long run it is a weighing machine." The speed at which a business's success is recognized, furthermore, is not that important as long as the company's intrinsic value is increasing at a satisfactory rate. In fact, delayed recognition can be an advantage: It may give us the chance to buy more of a good thing at a bargain price.

Sometimes, of course, the market may judge a business to be more valuable than the underlying facts would indicate it is. In such a case, we will sell our holdings. Sometimes, also, we will sell a security that is fairly valued or even undervalued because we require funds for a still more undervalued investment or one we believe we understand better.

We need to emphasize, however, that we do not sell holdings just because they have appreciated or because we have held them for a long time. (Of Wall Street maxims the most foolish may be "You can't go broke taking a profit.") We are quite content to hold any security indefinitely, so long as the prospective return on equity capital of the underlying business is satisfactory, management is competent and honest, and the market does not overvalue the business.

Source : Warren Buffett's Letters to Berkshire Shareholders in 1987

http://www.berkshirehathaway.com/letters/1987.html

____________________________________________________________________

What I've learned from this Article:

1. In the short run, the market is a voting machine but in the long run it is a weighing machine.

2. Warren Buffett looks into each business individually, buying it to own forever (as long as the business's intrinsic value grows at a satisfactory rate every year).

3. Warren Buffett doesn't bother about the market, or the interest rates, unemployment rates, He's only interested in price and value.

4. Warren Buffett is not bothered about whether the stock market closes the next day, week, months, or even years. Eventually, investment return on his stocks will be determined by the business return of that stocks.

5. Price fluctuation is not a risk, as you're not forced to act on it. Infact, price fluctuation is an advantage as it does gives an occasional mouth watering opportunities to buy good businesses at a fraction of what it's truly worth.

6. Do know that market price does not equal to business value. When it differs significantly, use it to your advantage.

7. The market is there to serve you, not to guide you.

8. If you aren't certain that you understand and can value your business far better than the overall market, you don't belong in the game.

9. Investment success will not be produced by arcane formulas, computer programs or signals flashed by price behaviour of stocks and markets.

10. An investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behaviour from the super-contagious emotions that swirl about the marketplace.

How about you? What have you learned from this article?

Thursday, October 30, 2008

The Superinvestors of Graham-and-Doddsville

Reprinted [1.624 kB PDF-File] from Hermes, the Columbia Business School Magazine.

Part 1: Walter J. Schloss

Part 2: Tom Knapp & Ed Anderson

Part 3: Warren Buffett

Part 4: Bill Ruane

Part 5: Charles Munger

Part 6: Rick Guerin

Part 7: Stan Perlmeter

Part 8: Value-Oriented Fund Managers

Part 9: Conclusion

After re-reading the article, I'm strongly convinced that EHM is crap! And so is Beta, CAPM and MPT <-- which sounds like "Empty". Going forward, it'll be a huge challenge for me to study CFA, which these academicians are preaching these stuff.

I, of course, prefer to read about Warren Buffett, Value Investing, Valuation of companies. :-)