Thursday, November 8, 2012

Fund's return vs Shareholder's return in ICAP

But the same can't be said to your return as a shareholder during these period. The market price on 22nd June 2012 is only RM 2.15, giving you a return of negative 22.7%.

Why is NAV grows 32.4% during these period, while your return as a shareholder is -22.7% ?

It's because at the time of purchase, you're paying 25.2% PREMIUM over NAV, and at the time of sale, people is paying you 26.9% DISCOUNT over NAV.

While buying at discount to NAV is good, it is at the expense of the seller. So is vice versa to buying at premium.

Thus, the best way to be fair to both buyer and seller for the fund to trade close to its NAV, and the best way to achieve this is to have a policy by ICAP to ensure that the gap between NAV and market price isn't wide (say, anything more than plus or minus 5%).

Data available here: http://www.icapital.my/en/weeklynav

And the reason i vote for Laxey is because i'm voting for the gap between market price and NAV to reduce to be fair to both the buyer and seller. Although i know most of you are long term investors, but should you decide to sell one day, you would want to sell at a fair price, don't you?

Just like in Politics. Many vote for PKR not because they want Anwar. But it's because they want "change".

TTB, hope you'll close the gap by setting policy in place.

Tuesday, November 6, 2012

Letter to shareholders of Icapital.biz Bhd. from Laxey Partners Ltd, the largest single shareholder in the company

As of 2nd November 2012, funds managed by Laxey Partners Ltd ("Laxey") owned 9,645,191 shares in Icapital.biz Bhd ("ICAP"), being 6.89% of the shares in issue. Laxey have been a Shareholder since 2010 in ICAP.

The purpose of this letter is to provide Shareholders with information relating to the Resolutions to be tabled at the forthcoming AGM. We would urge you to:

Vote Against Resolution 3: To re‐elect Datuk Ng Peng Hong @ Ng Peng Hay

Vote Against Resolution 4: To re‐elect Dato’ Dr. Norraesah Binti Mohamad

Vote Against Resolution 6: To re‐appoint Tunku Tan Sri Dato Seri Ahmad

Vote Against Resolution 7: To re‐appoint Tunku Abdul Aziz bin Tunku Ibrahim

Vote FOR Resolution 10: To elect Mr. Andrew Pegge as Director

Vote FOR Resolution 11: To elect Mr. Lo Kok Kee as Director

Vote FOR Resolution 12: To elect Mr. Low Nyap Heng as Director

Vote Against Resolution 13: To elect to elect Dato’ Tan Ang Meng as Director

Vote Against Resolution 14: To elect Dr. Yin Thing Phee @ Yin Thing Phi as Director

The Rationale:

Massive Persistent Discount:

While the manager has done a good job by delivering a NAV growth which has outperformed the FTSE Bursa Malaysia KLCI Index since inception, we are concerned about the substantial discount to Net Asset Value (“NAV”) that the fund has traded at and indeed continues to trade at. For the record we attach two charts from the Company 2012 Annual Report:

Independence of the Board & Corporate Governance Issues:

The Chairman, Tunku Tan Sri Dato Sri Ahmad bin Tunku Yahya, is non‐independent because of his indirect shareholding in Capital Dynamics Asset Management S/B, the Fund Manager of the Company. From 1982 to 1993, he was Group CEO of the Sime Darby Bhd Group and until 2007, was its Deputy Chairman. An Independent Director, Mr. David Loo Kean Beng, started his career with Sime Darby Berhad in 1987 and left in 1997 as Senior Legal Adviser. Another INED, Tunku Abdul Aziz bin Tunku Ibrahim, was at one time, group director of Sime Darby Ltd, the exact period for which has not been specified.The present composition of Directors would meet the requirements of the Bursa listing rules, but in terms of corporate governance, is it ideal? Should our Board be filled by a group of Directors with past ties to each other?

On 1st November, the Company announced the 5 additional nominees for election as Directors of the

Company at the forthcoming AGM.

Moving Forward:

We believe that a Board of Directors should bring forward proposals to eliminate or substantially narrow the discount that the shares of the Company trade at relative to their NAV. This is a growing problem for our Company.The Company could, as a minimum, consider implementing a share buy‐back scheme in accordance with the provisions of Section 67A of the Companies Act, 1965 of Malaysia, in order to give investors confidence and to boost the demand for the shares of the Company. We believe that the Board should concurrently engage advisors to research other methods to permanently remove the substantial discount at which the shares trade.

We have lost our confidence in the ability and commitment of the Board to address such an important issue.

Conclusion:

Profile of Andrew Pegge:

Andrew Pegge, a British citizen, is 100% independent of the ICAP.Andrew Pegge started his investment career with Laurentian Fund Management in 1987. In 1990 he joined Buchanan Partners Limited where he was initially responsible for systems planning and integration, later developing a process of systematic analysis and management of investment situations in both mainstream and emerging equity markets. In 1995, Andrew, with Colin Kingsnorth, set up Kingpin, where as Chairman he had responsibility for managing the group's global emerging markets; Following the decision to relocate to the Isle of Man, Andrew spent six months with the Isle of Man Financial Supervision Commission as Supervisor of Collective Investment Schemes. After 8 months in this role he left, in late 1999 to found Laxey Partners Limited again with Mr Kingsnorth. He holds an Honours degree in Psychology and Cognitive Studies, an MBA and is a CFA charter holder.

Mr Pegge currently sit on the boards of a number of public listed companies as Independent Non‐ executive director, including ASA Limited – a Bermudan domiciled New York Stock Exchange listed fund that comes under the supervision of the United States SEC; Sefalana Holding Company a company both domiciled and listed in Botswana; and the Value Catalyst Fund Limited – a fund managed by Laxey Partners that recently delisted having offered shareholders the opportunity of electing for realisation shares at NAV. He contributes significantly in his roles as Member of various board committees.

Profile of Low Nyap Heng:

Mr. Low Nyap Heng is a Malaysian, aged 61 and a Fellow member of the Institute of Chartered Secretaries and Administrators, United Kingdom. He was the Chief Executive Officer of Ayer Hitam Tin Dredging (Malaysia) Berhad from 1991 to 1993. He had also served as Executive Director of Kampung Lanjut Tin Dredging Berhad and Director of Roxy Industries Malaysia Berhad and Projects for Asia Management Sdn Bhd. He was also the Executive Director of Jackin International Holdings Limited from 2003 to 2007, the shares of which are listed on the main board of The Stock Exchange of Hong Kong Limited. Currently he is the Vice President of Cen‐1 Partners, a corporate advisory and consultancy firm in Hong Kong.Profile of Lo Kok Kee:

Mr. Lo was director and shareholder of Jupiter Securities Sdn Bhd, participating organization of Bursa Malaysia Securities Bhd. Prior to that, he was director and shareholder of OSK & Partners Sdn Bhd, the forerunner of the present OSK Investment Bank.Mr. Lo has long been involved in shareholder activism, before it became fashionable. In 1990, he unsuccessfully proposed the open‐ending of Overseas Union Securities Ltd.(OUS), a closed‐end fund listed on the Singapore Stock Exchange, which was trading at persistent deep discount to net asset. OUS has since merged with United International Securities Ltd. while the other two closed‐end funds, Harimau Investments Ltd and General Securities Investment Ltd, had gone into members’ voluntary liquidation, after failing to narrow the persistent discount to NAV.

More recently, in 2009, he initiated and successfully moved the members’ voluntary liquidation of Amanah Harta Tanah PNB2 (AHP2), an underperforming real estate investment trust managed by PNB, the first such liquidation in the history of the Bursa. Members were able to realise a distribution of RM 1 compared to the prior market price of around 50 sen/unit.

Mr. Lo holds bachelor degrees in Agriculture and Economics from the University of Saskatchewan, Canada as a Colombo Plan scholar. He also holds an MBA, majoring in Finance and Accounting, from the Chicago Booth Business School, University of Chicago, where he studied under Nobel laureates Professors Merton Miller and Myron Scholes.

Thursday, October 15, 2009

Is a low price fund means higher potential gains?

A fund’s price is determined by the underlying asset’s closing market price divide by total number of units of that fund on that particular day. This is the equation:

Fund’s Unit Price = Underlying Asset’s Closing Market Price / Total Units in the fund.

From the above equation, the fluctuation in a Fund’s Unit Price depends on the Underlying Assets, and it doesn’t depend on the fund’s Unit Price. After all, a fund’s unit price depends on “how many slices the fund is sliced”. The more units sliced, the fund’s unit price will be lower.

In fact, if both funds have the same Assets in the same proportion, both funds will fluctuate in the exact percentage, irrespective of the number of units in the fund. Putting it in a laymen way, if Fund A with unit price of RM 0.20 per unit increased by RM 0.10, then fund B with unit price of RM 1.00 per unit will increase by RM 0.50 (and NOT RM 0.10)!, if both funds have the same underlying assets at the same proportion. Both funds will increase by the same percentage, and not by the same amount!.

How about in reality (as oppose to the above “theory”)? Let’s take a look at 2 funds from one of the unit trust companies in Malaysia.

Fund A’s unit price is RM 0.4042 on 2nd Oct 2006, while Fund B’s unit price is only RM 0.2156. If a person wants an “aggressive” fund (fund which fluctuates in prices a lot), does it mean that Fund B is better? Or does it mean that fund B have more potential for higher return simply because the fund price is lower? Let’s take a look at their month by month’s prices from 2nd Oct 2006 until 1st Oct 2009 below:

Fund A (the fund that have a unit price almost double of Fund B) have (in terms of percentage):

a) Higher Return

b) Higher advancement from the lowest price to the highest.

c) Higher changes in a month

In conclusion, a fund’s unit price does not tell whether the fund is a volatile fund, better potential for higher returns or it’s an undervalued fund.

A much better way to measure a fund’s volatility (fluctuation in unit prices) is looking at:

- Fund’s Asset Allocation (percent in Equities, Bonds, and Money Market).

- Funds that invest mainly in Equities will fluctuate more than funds that invest mainly in Bonds.

- Funds that invest mainly in Bonds will fluctuate more than funds that invest mainly in Money Market.

- In fact, more than 90% of the long term return can be attributed by Asset Allocation. - Fund’s objective/ restrictions or sub-category of the Assets Class.

- Funds that invest in overseas will fluctuate more than funds that invest locally (due to currency exchange fluctuation)

- Funds that invest in high dividend paying stocks will fluctuate less than funds that invest in low dividend paying stocks (like growth stocks).

- Funds that invest in a specific sector/ group will fluctuate more than funds that are well diversified (no particular concentration on any sector/ group).

- Though these factors do determine the fund’s fluctuation, but it doesn’t play a big role like (1) above.

Luckily for laymen, FMUTM did a good job to make it compulsory for all unit trust funds that have 3 years track record to publish their fund’s volatily. Read their full article here: http://fmutm.com.my/doc/BrochureinvestorMay09.pdf .

Anyone still thinks Berkshire Hathaway class A at USD 100,000 per share is “expensive” when compared to a “cheap” share of USD 1 per share?

More often than not, it’s the other way round!.

Monday, July 20, 2009

Obvious Mispricing / Inefficiency of 2 stocks in Bursa Malaysia

This is what happens with two of the stocks in Bursa Malaysia.

Kuala Lumpur Kepong Bhd (KLK) is 46.57% owned by Batu Kawan Berhad Bhd (BKAWAN) (See Appendix (a) for the source of the information). At market price of RM 12.00 per share (at 16th July 2009), the market value of KLK is RM 12.673 Billion , based on 1,064,965,692 shares outstanding (See Appendix (b) for the source of the information).

Since BKAWAN owns 46.57% of KLK, the fractional ownership in KLK is worth RM 5.951 Billion. On top of that, BKAWAN owns RM 386.4 Million of other Tangible Equity, out of which RM 135.4 Million is Net Cash (defined as Total Cash & Cash Equivalent minus Total Debts of the company) (See Appendix (c) for the source of the information).

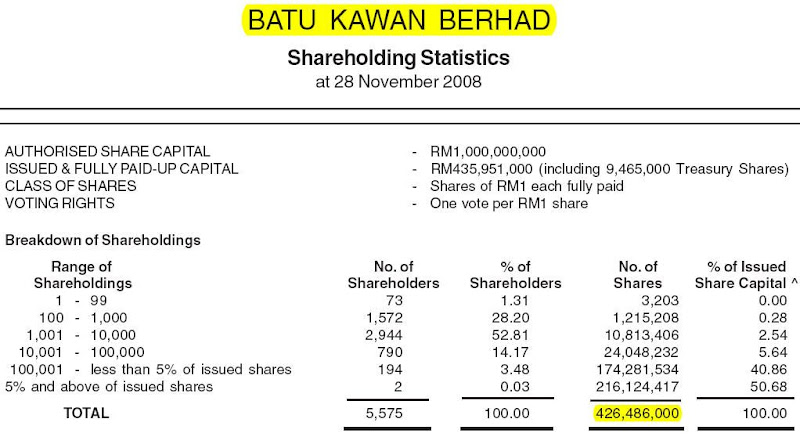

As at 31st March 2009, the number of shares outstanding in BKAWAN (after deducting treasury shares) is 426,487,000 (See Appendix (d) for the source of the information). Given the share price of RM 8.70 on 16th July 2009, the market value of BKAWAN is only RM 3.710 Billion !

Or putting in a table format for BKAWAN, you’ll get (based on 16th July 2009 closing price) (refer to Table 1):

Table 1 : Price vs Value of the entire company of Batu Kawan (BKAWAN)

Stating this, each share of BKAWAN is definitely worth more than KLK share (after all, each BKAWAN shareholders owns 1.1628 shares of KLK + others assets too).

But the market priced KLK share higher than BKAWAN. Infact, BKAWAN is only priced at RM 8.70 while KLK is priced at RM 12.00!.

If you see this as madness, then look at per share basis for BKAWAN (refer to Table 2):

Table 2 : Price vs Value for 1 share of Batu Kawan (BKAWAN)

And if you compare KLK share with BKAWAN share side by side, you’ll get Table 3:

Table 3 : 1 share of KLK vs 1 share of BKAWAN

The more obvious BKAWAN is a better value compared to KLK, the less obvious why “investors” would want to own KLK at higher price and not BKAWAN, which is selling at a lower price than KLK!. If you wonder why people would buy or own shares of KLK at RM 12.00 and not BKAWAN at RM 8.70, I can only share a line from a song by Michael Jackson, “You are not Alone – I am here with you”.

Some “investors” might say KLK have higher volume, which makes it easier for them to trade. On this, it reminds me of a quote by Warren Buffett, “Ease of divorce should not be the reason for marriage”. Infact, he also says, “If you don't feel comfortable owning something for 10 years, then don't own it for 10 minutes.”

Finally, I end with a quote by Warren Buffett on Fortune Magazine (April 3, 1995). He says, “I’d be a bum on the street with a tin cup if the markets were always efficient.” There are mispricing in stocks / securities, if we’re hard working in finding them.

Disclaimer: This article does not constitute a recommendation for buy or sell any stocks or securities. It is purely meant for educational purpose, and the author is not responsible for any loss arising from trade as a result from this article.

b) Shares outstanding for KLK can be found in the 2008’s annual report (http://announcements.bursamalaysia.com/EDMS/subweb.nsf/7f04516f8098680348256c6f0017a6bf/bd4d7b1afc5330534825752f0018ed3f/$FILE/KLK-AnnualReport2008%20(2.8MB).pdf ) page 131 of 141 from the pdf file (or page 129 from the page number in the report).

c) BKAWAN’s tangible assets can be calculated by using the company’s “Equity attributable to equity holders of the company” minus “Goodwill on consolidation” from the 31st March 2009 Consolidated Balance Sheet of BKAWAN’s quarterly report. (http://announcements.bursamalaysia.com/EDMS/AnnWeb.nsf/all/482568AD00295D07482575C3003216F8/$File/BKB%20Q2%202009.pdf ) page 2 of 11 from the pdf file or from the page number in the report.

- “Equity attributable to equity holders of the company” = RM 2,707.3 Million

- “Goodwill on consolidation” = RM 18.4 Million

- “Tangible Equity” = RM 2,707.3 Million - RM 18.4 Million = RM 2,688.9 Million

Since KLK is stated as RM 2,302.5 in the book, the balance (called “Other Tangible Equity”) is RM 386.4 Million.

BKAWAN’s Net Cash can be calculated by using the company’s “Cash and Short Term Investments” minus “Total Debt” from the 31st March 2009 Consolidated Balance Sheet of BKAWAN’s quarterly report. (http://announcements.bursamalaysia.com/EDMS/AnnWeb.nsf/all/482568AD00295D07482575C3003216F8/$File/BKB%20Q2%202009.pdf ) page 2 of 11 from the pdf file or from the page number in the report.

- “Cash and Short Term Investments” = “Short Term Funds” + “Term Deposits” + “Cash and bank balances” = RM 98.4 Million + RM 70.7 Million + RM 1.9 Million = RM 171 Million

- “Total Debt” = “Term Loans” = RM 35.6 Million

- Net Cash = RM 171 Million – RM 35.6 Million = RM 135.4 Million

d) Shares outstanding for BKAWAN can be found in the 2008’s annual report (http://announcements.bursamalaysia.com/EDMS/subweb.nsf/7f04516f8098680348256c6f0017a6bf/d34a06927b8249ef482575280014e45d/$FILE/BKAWAN-AnnualReport2008%20(300KB).pdf ) page 84 of 89 from the pdf file (or page 82 from the page number in the report).

Sunday, June 21, 2009

Very good article , "Buffett advice: Buy smart...and low"

____________________________________________________________________

In response to a question from Barbara Kiviat of Time on how he and Munger control their emotions, Buffett replied: "[It] comes about from having an investment philosophy grounded in the idea that a stock is a piece of a business. If you look at it that way, there's no reason to get excited whether some analyst is recommending it or the company is splitting the shares two-for-one, or whatever. The only way to drive the extraneous thoughts out of your mind is to have a philosophy. And for us that philosophy comes from Benjamin Graham and The Intelligent Investor, especially chapters 8 and 20. It's not very complicated stuff."

You need a philosophy and the ability to think independently...It doesn't make any difference what other people think of a stock. What matters is whether you know enough to evaluate the business.

You should be able to write down on a yellow sheet of paper, 'I'm buying General Motors at $22, and GM has [566] million shares for a total market value of $13 billion, and GM is worth a lot more than $13 billion because _______________." And if you can't finish that sentence, then you don't buy the stock.

The key is not to be seduced by crazy ideas, but instead just stick to the fundamentals year after year. Academia doesn't get too interested in us -- we're too simple. What would the professors do? A great many of the formulas [they use to analyze securities and markets] are dead wrong. They exist purely to give the intellectual class something to do. We don't do anything just exercise our intellectual proclivity for mathematical formulas.

There's no reason we should become fearful if a stock goes down. If a stock goes down 50%, I'd look forward to it. In fact, I would offer you a significant sum of money if you could give me the opportunity for all of my stocks to go down 50% over the next month.

In that single sentence Buffett captured the difference between investing and speculating: An investor, like Buffett, wants the price of a stock to fall below the value of its underlying business so he can buy even more and hold for as long as possible. A speculator (like Jim Cramer) only wants the price of a stock to go up, with no regard for the value of the underlying business at all, so he can sell as fast as possible. To the investor, the market's opinions do not matter. To the speculator, they are the only thing that matters.

A Chinese reporter asked whether Berkshire will be buying more stocks in China now that its market has fallen by almost half, and what the next year will hold for Chinese investors. Buffett's answer held a lesson for investors based anywhere. "We're not in the business of forecasting what the market will do in the next year," said Buffett. "But if a market goes down, we like that. There's no way Charlie and I get upset when stocks go down. We like it, because falling prices give us the opportunity to buy more good businesses at better prices."

____________________________________________________________________

Read the full article here : http://money.cnn.com/2008/05/05/news/companies/buffet.pm.wrap/

Tuesday, March 31, 2009

Discrepancy in IOI Corp and IOI Properties Stock price

Let me share some background info:

1. On 4th February 2009, IOI Corp issues a Voluntary Take-Over Offer to take over IOI Properties at:

- 0.6 shares of IOI Corp , and RM 0.33 CASH for every 1 share of IOI Properties.

Full Details of the offer is here.

2. Then, on 30th March 2009, IOI Corp have already received (plus their own ownership in IOI Properties) in excess of 90% of the shares outstanding. Since they own more than 90%, the remaining shareholders of IOI Properties are "forced" to convert their shares to IOI Corp at above terms. Full Details of the 90% ownership of IOI Corp is here.

3. By 7th April 2009, IOI Properties would be delisted from Bursa Malaysia, and converted to IOI Corp shares at above terms.

So, the equation below must hold true.

1 IOI Properties share = 0.6 IOI Corp shares + RM 0.33 CASH

If the above equation differs by anything more than the brokerage fees involved (say, 1.5%), then arbitrage opportunity would arise.

As of this writing (4.30 pm on 31st March 2009), you can buy IOI Properties at RM 2.50 per share, and you can sell IOI Corp at RM 3.80 per share. Fitting it to the equation above:

Left Side : 1 IOI Properties share = RM 2.50

Right Side: 0.6 IOI Corp shares + RM 0.33 CASH = RM 2.61

That's a difference of 11 cents, or 4.4% !. Seeing this, I can buy 100,000 shares of IOI Properties at RM 2.50, and "sell" 60,000 shares of IOI Corp at the same time.

This way, i'm making a nearly risk free return of at least 3.4% in a week (that's the holding period for my IOI Properties shares to be converted to IOI Corp shares). After my IOI Properties shares is being converted to IOI Corp shares, i'll "return" the IOI Corp shares back to cover my short selling position.

Nice Arbitrage Opportunity? Too bad Short selling is not allowed in Malaysia since 1998. :-(.

However, if you own IOI Corp shares, you can sell those shares, and buy IOI Properties shares (with the above proportion). 1 week later, you'll have back the same number of IOI shares, and make at least 3.4% profit (assuming total brokerage fee is 1% both sides).

I know i would do that if i manage a portfolio of a few hundred Millions like a mutual fund. :-).

Would i just buy IOI Properties (without short selling IOI Corp at the same time), in the hope that i can sell IOI Corp shares at that above price 1 week later to make 3.4% profit?.

No, i won't. That involves risk, and possibly i might lose money. To me, this way is Speculation (and not Investing). Read the difference between Investing and Speculating here.

Friday, January 23, 2009

One-on-One with Warren Buffett by Nightly Business Report

Video of the complete 24-minute conversation has been posted on the program's website.

Transcript of that entire interview available as a PDF download.

Some of the excerpts of the interview:

Buffett: We’ve spent a lot of money. We’ve got money left, but I love spending money. Cash makes me very unhappy. I like to always have enough and never way more than enough, but I always want to have enough. So we would never go below $10 billion of cash at Berkshire. We’re in the insurance business - we got a lot of things. We’re never going to depend on the kindness of strangers. But anything excess in that, I love the idea of buying things and the cheaper they get, the better I like it.

Buffett: I am unquestionably optimistic about the long-term. I’m more than a little pessimistic about the short-term, but that doesn’t mean I am pessimistic about the stock market. We bought stocks today. If you tell me the economy is going to be terrible for 12 months, pick a number, and then if I find something that is attractive today, I am going to buy it today. I am not going to wait and hope that it sells cheaper six months from now. Because who knows when stocks will hit a low or a high? Nobody knows that. All you know is whether you’re getting enough for your money or not.

Buffett: Well, I’ve learned my lessons before that. I read a book, what is it, almost 60 years ago, roughly, called The Intelligent Investor, and I really learned all I needed to know about investing from that book, and particularly chapters 8 and 20. So I haven’t changed anything since. I see different.

GHARIB: Graham and Dodd?

BUFFETT: Well, that was Ben Graham’s book The Intelligent Investor. Graham and Dodd goes back even before that, which was important, very important. But, you know, you don’t change your philosophy, assuming you think have a sound one. And I picked up, I didn’t figure it out myself, I learned it from Ben Graham. But I got a framework for investing which I put in place back in 1950, roughly, and that framework is the framework I use now. I see different ways to apply it from time to time, but that is the framework.

GHARIB: Can you describe what it is? I mean, what is your most important investment lesson?

BUFFETT: The most important investment lesson is to look at a stock as a piece of a business, not as some little thing that jiggles up and down, or that people recommend, or people talk about earnings being up next quarter, something like that. But to look at it as a business and evaluate it as a business. If you don’t know enough to evaluate it as a business, you don’t know enough to buy it. And if you do know enough to evaluate it as a business and it's selling cheap, you buy it and you don’t worry about what it does next week, next month, or next year.

GHARIB: So if we asked for your investment advice back in 1979, back when Nightly Business Report first got started, would it be any different than what you would say today?

BUFFETT: Not at all. If you’d ask the same questions, you’d have gotten the same answers.

Friday, December 26, 2008

The Intelligent Investor - "By far the best book on investing ever written." - Warren E. Buffett

This comic describes how Warren Buffett feels when he first read the book "The Intelligent Investor" back then when he was 19 years old. This is his various quotes about the book.

“I went the whole gamut. I collected charts and I read all the technical stuff. I listened to tips. And then I picked up Graham’s The Intelligent Investor . That was like seeing the light .”

(Adam Smith, Supermoney (New York: Random House, 1972),p. 181.)

“I don’t want to sound like a religious fanatic or anything, but it really did get me. ”

(Source: L. J. Davis, “Buffett Takes Stock,” New York Times Magazine ,April 1, 1990, p. 16.)

“Prior to that, I had been investing with my glands instead of my head. ”

(Source: Warren Buffett correspondence to Benjamin Graham, July 17, 1970.)

Here's the Preface written by Warren Buffett on The Intelligent Investor.

Here's the Preface written by Warren Buffett on The Intelligent Investor.I read the first edition of this book early in 1950, when I was nineteen. I thought then that it was by far the best book about investing ever written. I still think it is.

To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions

and the ability to keep emotions from corroding that framework. This book precisely and clearly prescribes the proper framework. You must supply the emotional discipline.

If you follow the behavioral and business principles that Graham advocates—and if you pay special attention to the invaluable advice in Chapters 8 and 20—you will not get a poor result from your investments. (That represents more of an accomplishment than you might think.) Whether you achieve outstanding results will depend on the effort and intellect you apply to your investments, as well as on the amplitudes of stock-market folly that prevail during your investing career. The sillier the market’s behavior, the greater the opportunity for the business-like investor. Follow Graham and you will profit from folly rather than participate in it.

To me, Ben Graham was far more than an author or a teacher. More than any other man except my father, he influenced my life. Shortly after Ben’s death in 1976, I wrote the following short

remembrance about him in the Financial Analysts Journal. As you read the book, I believe you’ll perceive some of the qualities I mentioned in this tribute.

Warren Buffett recommended this book (The Intelligent Investor) so many times, and it's quoted below:

1966 Letters to his Partners in Buffett Partnership

The availability of a quotation for your business interest (stock) should always be an asset to be utilized if desired. If it gets silly enough in either direction, you take advantage of it. Its availability should never be turned into a liability whereby its periodic aberrations in turn formulate your judgments. A marvelous articulation of this idea is contained in chapter two (The Investor and Stock Market Fluctuations) of Benjamin Graham’s "The Intelligent Investor". In my opinion, this chapter has more investment importance than anything else that has been written.

1984 Letters to Berkshire Hathaway shareholders

(In what I think is by far the best book on investing ever written - “The Intelligent Investor”, by Ben Graham - the last section of the last chapter begins with, “Investment is most intelligent when it is most businesslike.” This section is called “A Final Word”, and it is appropriately titled.)

1990 Letters to Berkshire Hathaway shareholders

In the final chapter of The Intelligent Investor Ben Graham forcefully rejected the dagger thesis: "Confronted with a challenge to distill the secret of sound investment into three words, we venture the motto, Margin of Safety." Forty-two years after reading that, I still think those are the right three words.

1993 Letters to Berkshire Hathaway shareholders

In fact, the true investor welcomes volatility. Ben Graham explained why in Chapter 8 of The Intelligent Investor.

2003 Letters to Berkshire Hathaway shareholders

Jason Zweig last year did a first-class job in revising The Intelligent Investor, my favorite book on investing.

2004 Letters to Berkshire Hathaway shareholders

Some people may look at this table and view it as a list of stocks to be bought and sold based upon chart patterns, brokers’ opinions, or estimates of near-term earnings. Charlie and I ignore such distractions and instead view our holdings as fractional ownerships in businesses. This is an important distinction. Indeed, this thinking has been the cornerstone of my investment behavior since I was 19. At that time I read Ben Graham’s The Intelligent Investor, and the scales fell from my eyes. (Previously, I had been entranced by the stock market, but didn’t have a clue about how to invest.)

Alternatively, you can view each page individually, seperated by Chapters here. If it's too much, the 3 most important Chapters are as below:

- Chapter 1 : Investment vs. Speculation : results to be expected by the Intelligent Investor

- Chapter 8 : The Investor and market fluctuations

- Chapter 20: Margin of safety as the Central Concept

The 3 Bedrock Ideas above are the cornerstone of Warren Buffett's Billions. Watch the Video from my previous post.

Or if you prefer to own the book, you can get from Amazon from the links below.

Wednesday, November 26, 2008

Video conference with Walter J Schloss on 12 Feb 2008

Walter Schloss is one of the Superinvestors of Graham-and-Doddsville (Read more about his track record here: http://peterlim80.blogspot.com/2008/10/superinvestors-of-graham-and-doddsville_21.html ).

If there is one statement which is repeated a number of times by him, it is, “I don’t like to lose money.” I think that was the most used statement by him in the recording.

He seems to have very simple rules for investing:

1. Low Debt

2. Good History

3. Price

4. Management

5. Investor Characteristics

If you like this video, you can download it at : http://www.bengrahaminvesting.ca/Resources/Video_Presentations/Walter_J_Schloss.wmv

A good writeup about Walter J Schloss : http://www.gurufocus.com/news_print.php?id=21786

Wednesday, November 5, 2008

The Three "Bedrock" Ideas Behind Warren Buffett's Billions

Instead he listed three, using just 85 seconds to deftly describe the trio of "bedrock" ideas that have helped make him the world's richest man.

It all comes from this ....

Warren Buffett: The three most important lessons I learned were all from the same book, The Intelligent Investor. It was written first by (Benjamin) Graham in 1949. They appear in chapters 8 and chapters 20.

The first is, to look at stocks as pieces of businesses, not as little items on a chart that move around, not as ticker symbols, not as something that might split next week or next month or something of the sort. But, rather, to look at the business, value the business, divide by the shares outstanding, and decide whether you really want to own a piece of that business at that price.

The second one was his commentary about your attitude toward the stock market. That it is there to serve you rather than to instruct you, and he used the famous Mr. Market example of that. That attitude is fundamental to making money in stocks over time.

And the final item he talked about was margin of safety. When you buy a stock that you think is worth 10 dollars, you don't pay $9.95 for it, because you can't be that precise in estimating its value. So you leave a considerable margin of safety for both what you don't understand and for the vagaries of the future.

And those three ideas, which I learned when I was 19 years old, have been the bedrock of everything I've done since. Source: http://www.cnbc.com/id/24839084/

Monday, November 3, 2008

What Warren Buffett writes about marketable securities (or stocks)

Download the article in here: http://www.scribd.com/doc/7855212/Marketable-Securities

____________________________________________________________________

Marketable Securities - Permanent Holdings

Whenever Charlie and I buy common stocks for Berkshire's insurance companies (leaving aside arbitrage purchases, discussed later) we approach the transaction as if we were buying into a private business. We look at the economic prospects of the business, the people in charge of running it, and the price we must pay. We do not have in mind any time or price for sale. Indeed, we are willing to hold a stock indefinitely so long as we expect the business to increase in intrinsic value at a satisfactory rate. When investing, we view ourselves as business analysts - not as market analysts, not as macroeconomic analysts, and not even as security analysts.

Our approach makes an active trading market useful, since it periodically presents us with mouth-watering opportunities. But by no means is it essential: a prolonged suspension of trading in the securities we hold would not bother us any more than does the lack of daily quotations on World Book or Fechheimer. Eventually, our economic fate will be determined by the economic fate of the business we own, whether our ownership is partial or total.

Ben Graham, my friend and teacher, long ago described the mental attitude toward market fluctuations that I believe to be most conducive to investment success. He said that you should imagine market quotations as coming from a remarkably accommodating fellow named Mr. Market who is your partner in a private business. Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his.

Even though the business that the two of you own may have economic characteristics that are stable, Mr. Market's quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems. At times he feels euphoric and can see only the favourable factors affecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains. At other times he is depressed and can see nothing but trouble ahead for both the business and the world. On these occasions he will name a very low price, since he is terrified that you will unload your interest on him.

Mr. Market has another endearing characteristic: He doesn't mind being ignored. If his quotation is uninteresting to you today, he will be back with a new one tomorrow. Transactions are strictly at your option. Under these conditions, the more manic-depressive his behaviour, the better for you.

But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence. Indeed, if you aren't certain that you understand and can value your business far better than Mr. Market, you don't belong in the game. As they say in poker, "If you've been in the game 30 minutes and you don't know who the patsy is, you're the patsy."

Ben's Mr. Market allegory may seem out-of-date in today's investment world, in which most professionals and academicians talk of efficient markets, dynamic hedging and betas. Their interest in such matters is understandable, since techniques shrouded in mystery clearly have value to the purveyor of investment advice. After all, what witch doctor has ever achieved fame and fortune by simply advising "Take two aspirins"?

The value of market esoterica to the consumer of investment advice is a different story. In my opinion, investment success will not be produced by arcane formulae, computer programs or signals flashed by the price behaviour of stocks and markets. Rather an investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behaviour from the super-contagious emotions that swirl about the marketplace. In my own efforts to stay insulated, I have found it highly useful to keep Ben's Mr. Market concept firmly in mind.

Following Ben's teachings, Charlie and I let our marketable equities tell us by their operating results - not by their daily, or even yearly, price quotations - whether our investments are successful. The market may ignore business success for a while, but eventually will confirm it. As Ben said: "In the short run, the market is a voting machine but in the long run it is a weighing machine." The speed at which a business's success is recognized, furthermore, is not that important as long as the company's intrinsic value is increasing at a satisfactory rate. In fact, delayed recognition can be an advantage: It may give us the chance to buy more of a good thing at a bargain price.

Sometimes, of course, the market may judge a business to be more valuable than the underlying facts would indicate it is. In such a case, we will sell our holdings. Sometimes, also, we will sell a security that is fairly valued or even undervalued because we require funds for a still more undervalued investment or one we believe we understand better.

We need to emphasize, however, that we do not sell holdings just because they have appreciated or because we have held them for a long time. (Of Wall Street maxims the most foolish may be "You can't go broke taking a profit.") We are quite content to hold any security indefinitely, so long as the prospective return on equity capital of the underlying business is satisfactory, management is competent and honest, and the market does not overvalue the business.

Source : Warren Buffett's Letters to Berkshire Shareholders in 1987

http://www.berkshirehathaway.com/letters/1987.html

____________________________________________________________________

What I've learned from this Article:

1. In the short run, the market is a voting machine but in the long run it is a weighing machine.

2. Warren Buffett looks into each business individually, buying it to own forever (as long as the business's intrinsic value grows at a satisfactory rate every year).

3. Warren Buffett doesn't bother about the market, or the interest rates, unemployment rates, He's only interested in price and value.

4. Warren Buffett is not bothered about whether the stock market closes the next day, week, months, or even years. Eventually, investment return on his stocks will be determined by the business return of that stocks.

5. Price fluctuation is not a risk, as you're not forced to act on it. Infact, price fluctuation is an advantage as it does gives an occasional mouth watering opportunities to buy good businesses at a fraction of what it's truly worth.

6. Do know that market price does not equal to business value. When it differs significantly, use it to your advantage.

7. The market is there to serve you, not to guide you.

8. If you aren't certain that you understand and can value your business far better than the overall market, you don't belong in the game.

9. Investment success will not be produced by arcane formulas, computer programs or signals flashed by price behaviour of stocks and markets.

10. An investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behaviour from the super-contagious emotions that swirl about the marketplace.

How about you? What have you learned from this article?